With the app, you can easily create and process invoices on the go. Countingup can notify you when these invoices are received and automatically match them to payments. This contrast will help you know if you spend too much for your business compared to what you earn. With this information, you can decide when to cut down on expenses or increase your prices to earn more. If you subtract costs from the top-line figure of your revenue, then you can determine your net income. You can better plan for operating expenses for both immediate and future expenses.

Operating profit vs EBIT: What’s the difference?

By prohibiting the company from spending money that is not yet technically available to it, this can help avert cash flow issues. Look at both your total and net sales to ensure profitability and sound financial management. While your net revenue takes expenses into account, your total revenue provides more insight into your capacity for revenue generation. Nearly every part of your organization benefits from knowing your revenue. This gives you a better idea of how much money your company produces once the initial expenses are paid.

Join 41,000+ Fellow Sales Professionals

Revenue is the money a company earns from the sale of its products and services. Cash flow is the net amount of cash being transferred into and out of a company. Revenue provides a measure of the effectiveness of a company’s sales and marketing, whereas cash flow is more of a liquidity indicator.

How much will you need each month during retirement?

Price increases or decreases don’t have as much of an impact on overall revenue if demand is inelastic. In order to assess your company’s financial situation, you can also compare your overall sales year over year and perform a trend analysis. Take it a step further and conduct an industry analysis to compare your overall revenue to that of your competitors. Trend research and industry analysis both provide useful information about the financial health of your company. A line item labeled „other revenue“ may appear in a financial statement. The money a firm makes through ventures unrelated to its core business is known as this revenue.

- Your business is in deficit if your expenses are much more than your total income.

- Revenue is the amount of money a company receives from its primary business activities, such as sales of products and services.

- Non-operating revenue is received from any side activities your business performs.

- They can increase your total number of sales, resulting in higher sales revenue.

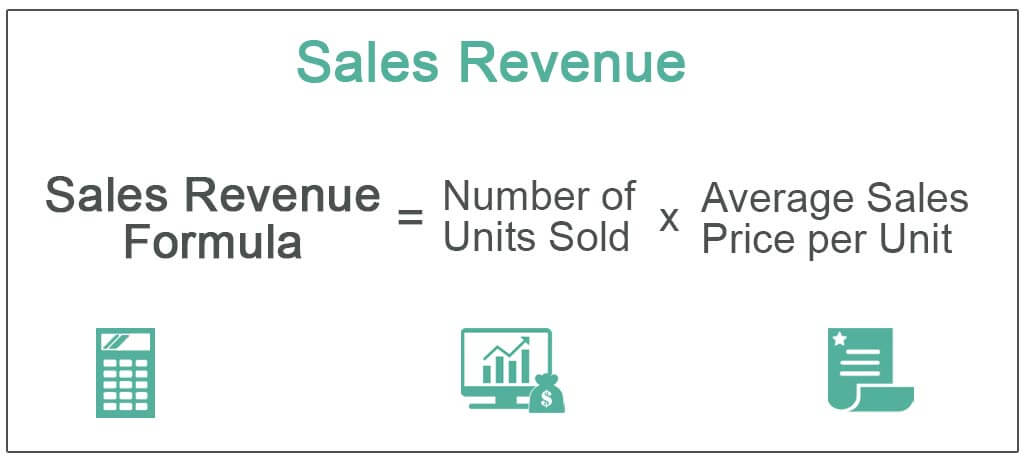

By keeping a close eye on your revenue, you can take steps to ensure the future financial health and therefore the success of your business. To find your total revenue for the period, plug the amounts into the formula. However, if you’re a product-based business, the formula for calculating sales revenue would look like the following. Understanding how to calculate total revenue can be important for your business. It will give you insights and a high level of understanding when it comes to the relationship between your customer and your pricing. In economics, total revenue is stated differently but ultimately means the same thing as total revenue in accounting.

Calculating Product Revenue

There must be a source document for each sale, which is typically a cash receipt. However, if you notice a drop in this figure, it may be time to review your pricing plan, marketing approach, or both. Total revenue may also include interest and profits from investments, depending on the nature of your organization. If you’re calculating net revenue, be sure to pull information on any sales or discounts you offered clients.

For instance, the amount of money is listed if a clothes store sells some of its inventory. You can determine any revenue growth over time by calculating your total revenue and comparing it to previous years‘ totals. Subtract the entire revenue from one year from the other to get this. Companies typically only disclose the net gain or loss from these non-operating income sources. On a company’s income statement, these amounts are denoted as non-operating income or occasionally as „other“ income.

The gains and losses for a given time period are shown on your income statement. On your income statement, total revenue typically shows as a separate line item. You can also use it to determine if your business has increased revenue year-over-year or from period to period. Then, you can use it to make necessary adjustments to your pricing and strategies to boost sales and increase total revenue.

Go one step further and compare your total revenue with your competitor’s total revenue by doing an industry analysis. Just add up the total revenue from how to find revenue in accounting each product and plug that into the equation. Revenue can be calculated by multiplying the price of goods or services sold by the number of units sold.