However, the discount must be taken into account when calculating the company’s net sales; as a result, the net revenue recorded by the company is $213 ($220 x 97%). This $213 is the sum that typically appears on the income statement’s top line. T-shirts are purchased by a corporation for $70, and they are sold for $110 each. If the customer uses cash to pay, they give a 3 percent discount. If a consumer purchases a t-shirt from the business and pays cash, the gross revenue reported by the business will be $220 ($110 multiplied by 2 pairs).

Revenue on the Income Statement

When revenue is earned, which may not necessarily coincide with when money is exchanged, it is reported on a company’s financial statements. Although revenue is a single number, there are numerous ways to interpret it. Let’s examine how total revenue and marginal revenue are related. The sum of money a business makes by selling its products and services is known as total revenue. In other words, businesses utilize this statistic to assess how effectively their primary sources of revenue are generating profits.

What Is the Difference Between Revenue and Income?

Revenue for federal and local governments would likely be in the form of tax receipts from property or income taxes. Governments might also earn revenue from the sale of an asset or interest income from a bond. Charities and non-profit organizations usually receive income from donations and grants. Universities could earn revenue from charging tuition but also from investment gains on their endowment fund.

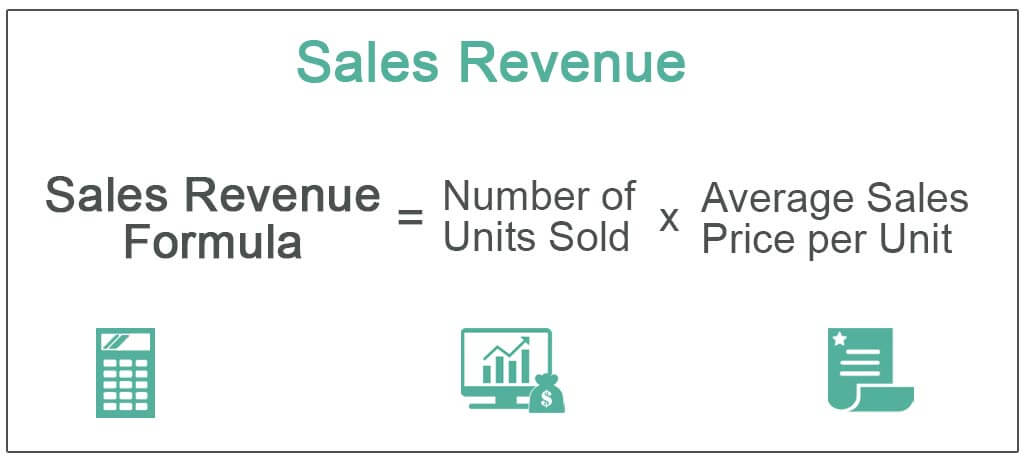

What Is the Formula for Revenue?

Revenue, often known as sales or income, is the first line of a firm’s income statement and is frequently referred to as the „Top Line“ of a company. A company’s profit, also known as net income, is calculated by deducting expenses from its revenue. Are you aiming towards having a healthy cash flow for financial stability of your business? This entails keeping an eye on your financial statements and computing financial metrics like total sales. After you calculate gross revenue, you can plug it into other formulas to find additional financial figures (e.g., net revenue). Your income statement reports your company’s profits and losses over a specific period.

How can you calculate your small business revenue?

Your business image can get the facelift it needs to appeal to the right customers by investing in skilled graphic designers, photographers, and copywriters. The text and images on your website or packaging must accurately reflect what your brand is all about. After all, investing money in print or digital advertising is pointless if consumers don’t like what they see or are unfamiliar with your brand.

How B2B Sales Teams Can Restore Their Pipelines in 2020

Total revenue is the amount of money your business made during a specific accounting period from the sales of its products or services. It is the first item you need to build the income statement, or profit and loss statement for your business, because it appears first on the income statement. There are several components that reduce revenue reported on a company’s financial statements in accordance with accounting guidelines. Discounts on the price offered, allowances awarded to customers, or product returns are subtracted from the total amount collected.

- However, they would not recognize the revenue on their income statement.

- There are many ways to generate revenue, but all businesses need to find a way to bring in more money than they spend.

- Operating revenue is revenue your business earns from its main line of business.

- It can be done either through brick-and-mortar stores or online platforms.

- By prohibiting the company from spending money that is not yet technically available to it, this can help avert cash flow issues.

- It is the top line of the income statement as compared with the bottom line, which is net income or net profit.

Revenue is recognized when it is earned, not when cash is received, according to the Revenue Recognition Principle and the Accounting Standards Codification (ASC) 6066. Coca-Cola reported a top-line revenue how to find revenue in accounting figure of $38,655,000 for 2021 and $10,042,000 in net income for the same period. Revenue can become complicated to account for, though, when a company’s production process takes an extended period of time.

Accrued revenue is the term given to revenue that is earned by a company. This is specifically for the successful delivery of goods or services that haven’t yet been paid for by the customer. In accrual accounting, when a sales transaction takes place, it is reported as revenue.

Explore the world of tax accounting and build skills employers are looking for with this free job simulation from KPMG. Analyze a company’s financials as an analyst on a technology team in this free job simulation. Finally, subtract taxes from pretax income to arrive at net income. Let us look at some examples to better understand the practical applications of revenue. Such keywords should be included in your website because they are significantly more likely to result in a sale. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

We’ve mentioned it before but since we are talking revenue, it is worth mentioning the revenue recognition standard. To be compliant with accrual accounting, revenue is recognized when earned. The gross income is calculated by deducting the direct costs against the revenue. Some companies may use the average sales price per unit, but that won’t give you an exactly accurate number. Ultimately, it can be complicated to calculate revenue depending on the type of business and the type of accounting.

By taking the time to develop a comprehensive forecast, you can give your business the best chance of weathering any unexpected challenges and achieving lasting success. In short, revenue can come without sales, but all sales are inherently revenue. Allowances are price reductions that the customer initiates because of an issue with their order. That can range from problems with quality, incorrect items, or longer than expected shipping times. A discount is a reduction in the basic price of goods and services. Expenses and other deductions are subtracted from a company’s revenue to arrive at net income.